What are the top Go-to-Market trends for 2023?

2023: The Year Of The Agile Efficient Selling Organization

Back in 2018, when I was a principal analyst at Forrester, I had a vision that sometime in the not-too-distant future, B2B sellers would partner with innovative sales tech that had embedded automation and artificial intelligence. Automation would drive massive efficiencies and Machine Learning algorithms run against robust data sets would serve up insights.

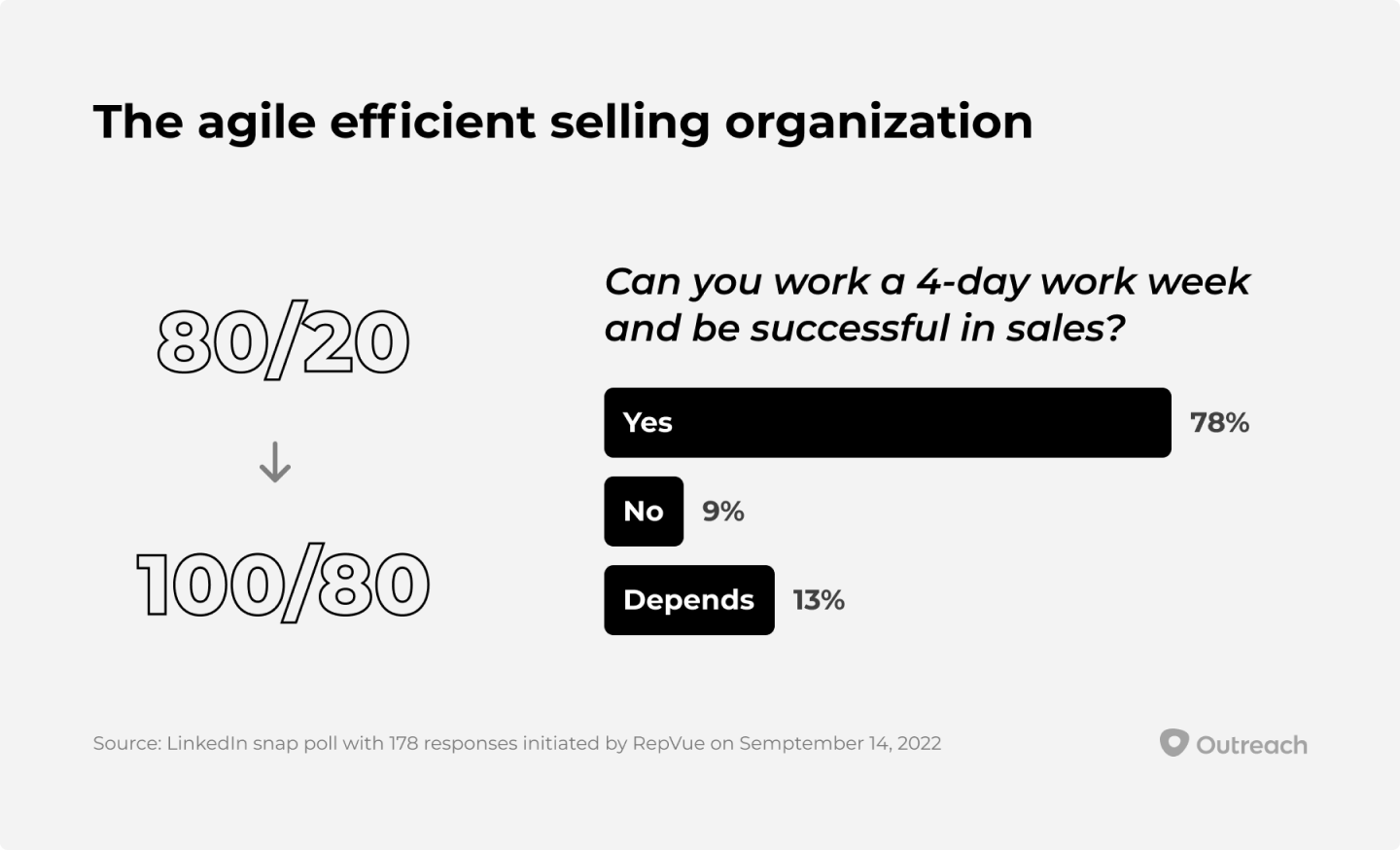

I foresaw a world where selling organizations would be smaller and more agile; where the best sellers would be highly consultative and would have a big impact on their customers’ success. Software reps would meet their buyers where their wallets were – on B2B Marketplaces where both parties would benefit from frictionless experiences. Because these sellers were so efficient, they would meet and exceed their quotas while working only 3-4 days a week.

Sellers are only part of the equation. Business buyers have changed dramatically over the last 5 years. Today, Millennials are the predominant deciders in business purchases and this and other buying cohorts are comfortable conducting research on their own, accessing peer reviews sites, leveraging interactive tools on supplier websites, and “remote” is the number 1 buyer preferred channel for a sales meeting*.

Seismic demographic shifts and evolving buyer preferences have fundamentally changed the roles and activities of B2B marketers and sellers. Marketers must support buyers deeper into their journeys and must support sellers across the entire revenue cycle. The days of marketers focusing almost exclusively on the top of the funnel are over. Marketers and sellers alike must now focus on creating and closing pipelines.

Based on current buying preferences today’s sellers now have less direct access to buyers and buying group members and less time to influence decisions. As a result, selling organizations will move away from SDR roles, and AEs will do their own prospecting and closing. In some cases, marketers and sellers will work side-by-side in “pods,” and in other cases, they will work harmoniously, partnering on key activities across the entire revenue cycle.

As the debate rages on regarding whether we are or are not in a global economic downturn, it’s clear senior executives are preparing for the worst. In a late 2022 survey of global B2B leaders conducted by Dynata on behalf of Outreach, 75% of respondents said they were planning for flat or reduced growth in 2023*. As we kickoff the new year while the recession question may still be unsettled, we know companies of all shapes and sizes are bracing for a tough environment.

Uncontrollable external events can often be force multipliers. Much in the way the global pandemic accelerated the latent trend of the digitization of the buying and selling process, the recession will accelerate the latent trend toward a more agile efficient selling organization. In the above-mentioned study, 68%** of business leaders are already actively planning to redeploy sales headcount in favor of innovative sales technologies. As the public markets reward efficient, profitable growth, B2B Marketplaces proliferate, and technology drives efficiencies to the likes we have not seen before, selling organizations will become smaller, agile, and efficient.

* Base: 212 directors+ that influence purchasing decisions across North America and UK organizations in various industries. Source: A commissioned study conducted by Forrester Consulting on behalf of Outreach, April 2022

** Base: 550 B2B business leaders across France, Germany, the UK, and the US. Source: Outreach’s How B2B Leaders Are Responding To Economic Headwinds Online Survey, October, 2022

2023 is going to be nuts, buckle up. If we look back on years past when we were in the throws of economic uncertainty, there are a lot of lessons to be learned.

- Some industries will use this as an opportunity to invest in technology to drive innovation and efficiency. This is both an opportunity and a challenge for many companies, for it requires a revaluation of your ICP and who you should target. Focus on industries like Insurance, Health Care, Consumer Services, Discounted / Used Goods, Remote Work, Logistics, and Budget Travel, to name a few.

- New deals will be harder to identify and win so focus on your existing customers. In a rocky environment, it’s critical you don’t lose a single customer. Focusing on driving value within your current customer base and leveraging tools to help you identify the white space opportunities within your existing customers will be crucial. We all know it’s easier to sell to an existing customer vs. landing new ones. This is particularly true in an unstable economy.

- Double down on training. This will likely be a new selling environment for many of you because we’ve seen nothing but froth in the last 12+ years. We now find ourselves in a situation where buyers will be more diligent in their evaluations. More senior executives will be involved in making buying decisions and buying cycles will take longer because of the decreased risk tolerance our buyers will have. What sales tactics worked in the past won’t work in this new environment. Sellers need to be even more empathetic, focus more on nurturing their relationships, focus more on adding value, focus more on winning big in the long run. Buyers will want more concrete examples of ROI and Value metrics. Many of our reps today are not skilled at having these more advanced conversations. You need to train them, help them, and develop them if you want to win.

- 2023 will see the largest attrition event in the history of SaaS

- 2023 will demand GTM efficiency

- The smartest companies will invest in product-led GTM in 2023

Attrition

We oversold.

No aspersions, no criticism, but we oversold.

Everything looked up-and-to-the-right for SaaS during COVID, purchasers extrapolated needs, and sellers sold to those extrapolations. Now not only did we not grow into the expectations, but we are contracting. Since lots of committed $ARR is stranded, managers are looking for the next opportunity to right-size their SaaS contracts. This will come home to roost in 2023.

What do we do about it?

- Reset expectations. We need to set expectations with our boards, so we can do what we need to do. We have a one-time event in 2023, and if we pretend we don’t, we will make desperate moves that will still not yield intended results.

- Be proactive. Having reset expectations, we need to approach each customer, ask what they need, and meet them where they are. Don’t reduce price / discount. Just reduce seats or servers or endpoints or whatever your licensing unit is. Our customers will appreciate our proactivity, and once the one-time reset is in the rearview mirror, their loyalty will persist.

- Focus on IMPACT. IMPACT is value delivered. It shows up as emotional IMPACT (like the good feelings our customers have when we call them proactively about a contract downsize) and rational IMPACT. We must focus on delivering and documenting both.

Efficiency

There is no money for scaling.

Unlike the past two decades–the effective career span of most current GTM managers–there is no money available to fund scaling.

We can’t invest.

We must fund our own growth.

This is not new, but it is. Almost no current GTM managers have ever managed in an environment where their job depended on achieving unit economics.

So we have to understand what “architected growth” really means.

Now we need to click into LTV:CAC and read all those white papers we’ve been filing away to read later.

We can no longer assume unit economics will get better over time (it was never true, but saying it made ourselves feel better).

What do we do?

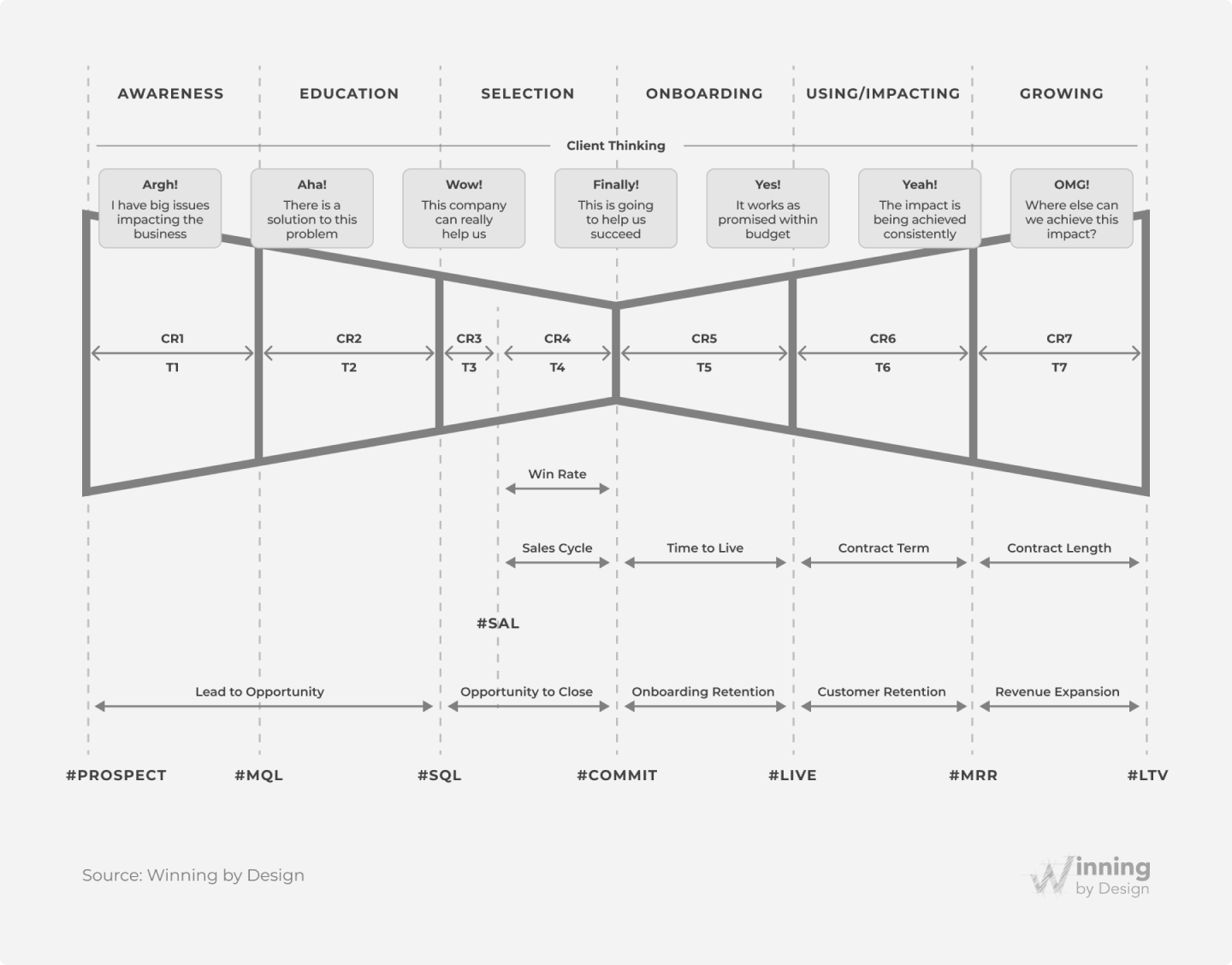

- Normalize the recurring revenue “Bowtie” (see image below). We need to know exactly which pieces of the machine are performing as expected, and which are performing in a way that diverges from expectation.

- Build a “growth formula” and “growth model.” With understanding gained in the bowtie normalization exercise, we can then model out what it takes to land a single new customer. Furthermore, we can derive the full-bowtie unit economics, and we can do this by GTM motion (e.g. one version for PLG, one for inbound, one for outbound, one for enterprise). Finally, we can model this into a future growth scenario that makes sense for our business and industry.

- Build Playbooks for each role and each GTM. Now that we know where we are deficient and what would need to be true to hit our growth targets, we need playbooks. What does our team do at each stage to ensure we are hitting targets and setting ourselves up for success?

- Train and coach to the above.

Product-Led Growth

2021:

Me: “I’ve become convinced that the future of software belongs to PLG.”

Jacco van der Kooij: “So you’ve had the aha moment, huh?”

Me: “I don’t know. What do you mean?”

Jacco: “You’ve figured out the math doesn’t work.”

Me: “Yes, I’ve had that aha moment.”

No matter how efficient we get at human-led growth, if there is any possibility of machines doing what humans can do, the machines will prevail. Why? Unit economics.

In 2023, smart companies will make investments in product-led GTM.

PLG Companies:

Those who are already PLG will feel pretty smug. Their unit economics are already stellar. They don’t need to “invest” in growth. They will fortify their advantage and continue to scale efficiently. They may delay adding sales, or they may be that much more circumspect about adding “Product-Led Sales” to their GTM mix, but all will get there eventually. This is an excellent place to be.

SLG Companies:

Those who built using human-led growth are busy downsizing their human teams and trying to figure out how not to sacrifice growth in the meantime. Spoiler alert: they will have to sacrifice growth in the short term.

No worries. The best time to plant a tree is 30 years ago; the second best time to plant a tree is today.

Sales-led companies will look to retrofit product-led GTMs into their motions to increase efficiency. These investments will take 3 years to pay off.

Impatient CEOs will ask their team to “hurry it up” and will look for $ARR returns sooner. Best case, they will be disappointed; worst case, they will mess up their teams’ efforts to build from fundamentals.

But thoughtful CEOs will treat this as an offensive and defensive investment in their own future. 3 years from now, with sunlight and water, their PLG tree will begin bearing fruit, and it will eventually be strong enough to support a Product-Led Sales motion (PLS), and they will be much better off than had they tried to “power through” the downturn.

Efficiency has never mattered more. GTM teams will find ways in 2023 to help buyers ascertain solution-fit of their software even closer to the top of the funnel than ever before. This will allow for less sales calls to just “see a demo” and more sales calls closer aligned to intent. See solutions from Reprise, Navattic, Consensus, etc.

GTM teams will operate as lean as possible and maximize team output from individual sellers vs. hiring large amounts of heads to fill the sales gap.

Sales and marketing teams focused on the enterprise will prioritize ways to see their customers “in person” but will need to find more efficient ways to do so (i.e.: conferences, invite-only dinners, and networking events that allow for large amounts of people to be seen and spoken to in short amounts of time.)

SMB/MM sales teams, or sales teams with short deal cycles, will begin to re-prioritize in-office and will find shorter onboarding times for new sellers. Cold calling and personal touch engagements will be a priority in order to have success for these teams. Quality of message will reign supremely over quantity. Enterprise sales teams, or sales teams that have a longer deal cycle (90+ days) will find an advantage to a team spread out remote as they will be able to see customers throughout different geographies. Building an authentic professional relationship will become a prerequisite prior to winning revenue dollars from any prospect.

NRR will become the most important growth metric for GTM teams. Companies able to substantially grow revenue through their current client base will be able to continue to show consistent growth while new business sales become harder.

Social selling will become the #1 GTM tool in the belt, spend will be scrutinized, and “nice-to-have” products will find headwinds. This will place an increased importance on attaching a product/solution to a business challenge impacting revenue growth.

LinkedIn selling, although a popular tool for social selling, will require a new GTM “playbook” to be created by teams. The noise in this channel will be so overwhelmingly loud that true connections and relationships will trump all. Sellers that have already built a network of individuals they can rely on from before Covid to now will have an advantage over sellers who have not yet created such networks.

In 2023 B2B marketers will need to focus on 2 key things: realigning on what marketing is and isn’t with leadership, and fixing clunky, disconnected tech stacks and internal processes.

First: As we started to be able to measure channels better, we became channel obsessed. We showed leaders how our website was driving leads. Or how an eBook turned into a sale. And they liked it. They asked for more. We began to try to orchestrate a way to show the impact of marketing. We became channel obsessed and myopic in our approach. And, we forgot the key things that marketing does—the only things marketing can really do. Take away the buzzwords, and this is the core of marketing. It always has been, and it always will be.

- Know your customers like they’re your best friend

- Build your brand and brand promise for your customers

- Align every marketing tactic, channel, and tech decision under your brand promise to gain awareness, understanding, and trust

- Build fantastic, stand-out creative that would make your best friend laugh, cry, or think

- Measure the impact on organizational growth over time

2023 will be the year that marketing turns away from quarterly results and measurements—we are not sales and will never be—to play the long game.

Second: Gartner predicts data complexity will increase fivefold over the next five years. What does that mean for marketing? Many B2B marketers are already wrestling clunky, disconnected tech-stacks and processes that require an advanced degree in project management. We cannot move at the speed our customers’ (best-friends’) demand if our tech stacks and internal processes move like the DMV Sloth in Zootopia. We need to stop and ask ourselves—to what end? What measurement should we really be doing? As Jon Miller, Chief Marketing Officer at Demandbase says, “Attribution shows up at the top of marketers’ wish lists. It makes sense. The promise of attribution is so seductive. I think it’s actually a myth. Attribution is at best a useful tool to help you build a model that gives you guidance about what works and doesn’t. My recommendation is to use attribution to improve your ROI, not prove your ROI.”

2023 will be the year that we begin to hone our tech stacks and process to align with the long-term measurement that will be required to serve our customers and ultimately our business—in the long run.

The Metaverse and Customer Engagement

In 2018, I wrote the first book (Sales Ex Machina) on how Artificial Intelligence was transforming the world of selling. This year I’m launching the first sales conference in the metaverse (SalesWorld.mv). I am convinced that the metaverse, and its application will change the world of customer engagement and by default how we sell (i.e., connect and close deals). Here’s how:

- Limitless Products and Shelf Space: In the metaverse, companies will be able to create virtual storefronts and showrooms, allowing customers to browse and purchase products in a virtual environment.

- Customer Journey: As more and more customers crave a ‘rep-free’ buying experience, the metaverse can help facilitate that need.

- Tightening Budgets: These virtual events also allow companies to reach a wider audience and reduce the need for physical travel. As we move deeper into a recession, companies will look for ways to reduce their cost of sales (COS) and operating expenditures (OpEx).

- Market Reach: The metaverse could eventually replace some live events, as they offer many benefits such as greater accessibility and the ability to reach a wider audience at a fraction of the cost.

Live events may continue to be important for certain types of events, such as concerts and experiential marketing activations. However, the metaverse will provide new opportunities for companies to reach and engage with their customers, as well as allowing customers to shop and interact with brands in a more immersive and convenient way.

SalesWorld.mv is a sales conference in the metaverse with over 20+ experts in the field of sales and leadership who share their expertise. Access is free and it’s open 24/7.

The market is speaking!

The sales profession must listen!

Consider the following:

If 72% of selling time is spent on sales-related activities yet only 28% of time is spent having conversations with the buyer, then the connection needed to have the conversations is not optimized. (Korn Ferry)

If 71% of buyers say the value provided in those sales conversations is not worth their time, then there is no value or depth. (The Rain Group)

If 53% of salespeople are not achieving targets due to not having these effective conversations with enough of the right connections, then it’s no wonder quota achievement is down. (Korn Ferry)

If 67% of sellers are living in a state of survival, burnout, and desperation, with cortisol their driving force because they are not able to convert these conversations, making them less effective, then the ripple effect on the economy is huge (Uncrushed Survey).

It’s not only Groundhog Day for sellers, but the dreaded Hamster Wheel is also in full operation, as well.

2023 calls for a new lens with which to look at the B2B approach to market.

And that lens is StorySelling (not just storytelling)

Story is nothing new.

In fact, story is our oldest form of communication.

Stories have been shown, shared, and told for centuries whether orally through song or chant or speech. Whether written on the clay tablets from 4000 years ago to the tablets of the 21st century. Whether visually through the hieroglyphics of Egypt’s pyramids and petroglyphs in the caves of New Mexico to modern day Tik Tok and Instagram.

Selling is nothing new, either.

In fact it is our oldest form of commerce.

StorySelling, however, dedicated to the sales profession, is new.

Wikipedia and the traditional dictionaries have yet to define the meaning of StorySelling. When you do a Google search you are likely to find a handful of sites that reference the words Story Selling with limited definitions around story telling. But not StorySelling specific to the sales conversation.

The articles you will find typically relate to:

- Product development

- Brand strategy

- Presentation skills

StorySelling as a portmanteau, therefore, marries the oldest form of communication (story) with the oldest form of commerce (sales) and is not leveraged nearly enough to achieve quota attainment, business relationships or personal fulfillment.

So what do we do with this very telling market feedback?

For 2023 and beyond, I see a combined focus on three levels of Commercial Leadership:

Personal Leadership with a focus on mindset (specifically the INTERNAL stories sellers tell themselves around identity, authority, and money).

Thought Leadership with a focus on mental models (visually capturing and collaborating EXTERNAL stories in a graphical way that serves the buyer and differentiates the seller).

Sales Leadership where new tools are plugged into existing sales operating systems and methodologies enabling true transformation to occur between seller and buyer (with the ability to elicit the all too often missed ESSENTIAL stories – our buyer’s stories!)

In the words echoed by Peter Drucker and Dan Pink – we are in the ‘wisdom era’ and need to become ‘wisdom workers.’ I predict 2023 will see a return to achieving the results that matter the most whereby sellers begin to stop selling widgets and start selling wisdom through the philosophy of StorySelling.

Economic headwinds, changing demands from buyers and customers, and the imperative to deliver predictable financial results will be front and center in 2023 (and likely beyond).

The increasing cost of capital and tightening of the availability of private funding will put pressure on many tech vendors. Growth at all costs is no longer being rewarded and we expect to see consolidation in the sales tech market as many narrowly focused, point solutions are unable to maintain market share. Buyers and administrators of sales tech are focused on adoption, value, simplification, and cost reduction.

We see three (3) primary impacts for buyers and providers of B2B sales technology.

- Buyers will demand simplicity, integration, and partnership from providers. With sales technology budgets expected to remain flat or decline for the near future, buyers of sales tech are seeking simplification of their overall sales tech stack, as well as the end-user experience. Providers of sales tech must seek to understand their buyers’ environment and present a solution tailored to their unique business needs.

- Sales technologies are (finally) moving from oversight and management, to end-user enablement and insights. Many of the early sales technologies began as tools to track and manage seller activity. The focus has clearly shifted to tools that automate non-core selling activity, capture data from multiple sources, and deliver actionable insights at the point-of-need to sellers, managers, and leaders. Sales technologies powered by AI, machine learning, and deep machine learning are driving a new age of predictive and prescriptive analytics that are helping personnel across the sales ecosystem make better decisions and optimize the customer experience.

- Changes in buyer and customer behavior are driving evolution of both providers and buyers of sales technology. The flood of innovative technologies is creating new opportunities for organizations to connect with buyers in a more automated, personalized, and timely way. However, there remains a gap between the experience customers expect and what B2B organizations can deliver. This is the driver behind many of the technologies that capture the voice of the customer across multiple interactions, both in-person and self-guided.

It’s both an exciting and challenging time for B2B sales technology. Those organizations that can demonstrate measurable value for their customers will thrive. Those that do not have a clear value proposition that aligns with their customer needs will struggle to survive.

Back in late January (11 months ago), I was reading one of my nerdy sales books from the 1920s and realized a storm was coming. I wrote about it on February 2nd.

The message was that the circumstances looked exactly as they do today. Steady growth, followed by an economic shutdown (back then, it was World War One), then a period of rapid growth, an inflation spike, then the bottom dropped out.

The sales community experienced 77% turnover in 1921, and 85% in 1922.

History repeats itself. Always. Especially in the sales community. Yes, we’ve had recessions before, but this one looks like 1920-1922, not like 2008’s.

We just finished an economy of steady growth (2017-2020), followed by an economic shutdown (Covid in 2020) , a period of rapid growth (late 2020-early 2022), a rapid inflation spike, then a slowdown.

“But what happened next, Todd?”

In 1922-1923, there was a return to a focus on “profitability” and “cash flow” versus the rapid growth period of “revenue at all costs” and “market capture”. Their “great resignation” of 1919-1920 ended, and the power in hiring and compensation swung back towards the hirers, not the hired.

Using history as a guide, we can predict with confidence that our pendulum is still swinging. We haven’t hit the bottom yet. The early part of 2023 will consist of continued hiring freezes, additional layoffs, and a focus on cash conservation and runway extension.

While there’s no way to predict how long the bottom end of the pendulum will last, it will smooth out, and bring us back to a focus on smart growth. The smart companies are focused on smart growth already, asking themselves the question, “How do we get the most from our precious resources of people, time and dollars?” That means:

- Invest in your people: Aside from just having the right people in the right places, can we ensure our team is getting the fundamentals right?

- Ensure your team isn’t wasting their time working on “science projects”: Are we optimally working on the right opportunities, the right individuals in those opportunities, and qualifying IN and OUT smarter?

- Capture economies of scale on your dollars, and invest in your leaders: The importance of optimized leadership goes up, as the ease at which sales just “happen” goes down.

Buckle up. We’ve had four different economies in less than three years. The next one will be a “smart growth” economy, hopefully to be seen sooner rather than later!

The B2B space has transformed over the last few years. Priorities have shifted, there is a semi-permanent hybrid work environment, and the buyer’s journey has changed once again.

Pitches and marketing drip campaigns are being ignored at an alarming rate.

Buyers are choosing vendors who are recommended by their trusted network. In fact, they rarely shop other vendors when one comes in with a high level of trust and credibility.

I predict that gaining access to influencers and decision makers will be based on social proximity and relationships NOT cold outreach.

Client referrals, networking introductions and permission to name drop will be the fastest ways to start conversations with our targeted audience.

In 2023, sellers will heavily rely on LinkedIn to proactively find pathways to buyers and leverage their existing relationships to start new ones.

Societal norms and ways of doing business are changing. Social connections are becoming more critical than ever. Striving to build professional relationships takes high priority, particularly online. Many may see our work, and we can make a difference upon connecting with collaborative peers.

With the same theme, no matter where we turn, diversity, equity, and inclusion are essential elements for a robust business and enjoying growth. When we only accept ideas from those who think alike, little is to be gained. But when we welcome input from people with varying backgrounds, experiences, and insights, we can aim for the stars in making change within ourselves and society.

The platform is changing how we work, and I believe for the better. LinkedIn is a global platform now on a mission to bring people together. For example, I frequently find suggestions of those with whom to connect, groups to consider joining, and organizations offering excellent insights.

I don’t believe cold calling is ‘dead’; it’s just reached a new level on social sites. Social sellers will do well to revisit their business skill set. It’s always best to become somewhat familiar with the other person, no matter the style, then attempt to sell upfront. When we reach out to connect and offer a reason why we ask, it’s no different than cold calling. However, the advantage is acceptance, access to our connections’ network, and collaboratively expanding our possibilities exponentially.

1. Partnerships will be the new Community

a. How many SaaS companies does it take to change a light bulb? Well, you need one to track the lightbulbs so you know when one’s out, one to send a message alerting you of the outage, and one to tell you how secure it is in the socket. Three companies, one solution, a huge waste of resources. By partnering with other companies, we gain the ability to meet needs and solve challenges in new and innovative ways.

b. We all want to be efficient and do our best to meet our customer’s specific needs. Partnerships help business leaders consolidate options for the customers, remove confusion, and create stickiness that is crucial for effective end-to-end solutions.

2. Attitude Adjustment: Companies need to ensure their GTM personality fits the purpose of their product.

a. Are you building a small business or starting an empire? Founders and investors need to face the truth of their operation in order to best cater to their demographic. In doing so, sales teams can align their efforts with the product market.

b. Growth is only as good as it is repeatable. Companies examining their data need to look for markers indicating the perceived value of their product, which will allow them to scale and advertise accordingly.

c. After this analysis, companies might be surprised to learn their true market opportunity if it’s not consistent with their original plan. But in order to foster a successful business, leaders need to be able to adjust their personality and operate with purpose.

When the going gets tough, the tough get going.

For many companies, especially in tech, the last ten years have been about “growth at all costs” and focusing on efficiency before effectiveness. Need more leads? Automate email outreach! More calls? Automate it! Need coaching? Automate it! Need sales insights? Use AI to automate it! The faster the growth, the higher the valuation. Companies raised capital at valuations 50 times gross revenue, even at huge losses.

But 2022 threw several curve balls: war in Europe, rising inflation, increased interest rates, and a massive correction of company valuations.

In 2023 and beyond, I hope to see old-fashioned business practices back on the agenda, like creating sustainable customer impact and generating profits. I want to see more companies become increasingly clear about the business outcomes they can help make, for which customers, with what value proposition, and well-articulated positioning. I want to see selling teams focus on their ability to have valuable conversations with existing and new customers.

For this to work, companies will need to invest in their go-to-market strategy and upskill their people to make their way of selling to become their competitive advantage. This will require investments in training and coaching revenue-generating teams and moving away from Frankenstacks to tailored sales platforms to support the execution more holistically.

Three focus areas that I expect to see more of in 2023:

- From account planning to account growth: Many companies pay lip service to account planning and spend countless hours filling out excel templates and PowerPoint slides about their key accounts. I want to see key account teams go from theory to action and grow together with their best customers.

- From reselling to co-selling: Selling through a channel can be a game-changer. It is also challenging, as few look to resell someone else’s solutions. There needs to be increased partner relationship trust and a move towards co-selling, where partners’ offerings merge into one cohesive and more holistic customer offering.

- A continued move from Frankenstacks to tailored platforms: Fired up by tech vendors’ colossal marketing budgets, the siren song of automation reached far beyond the technology space. Many companies bought new sales tools for each problem faced. However, research shows that too many tools create less effective salespeople. The emergence of more holistic platforms tailored to your way of selling will help companies move the focus from mindless efficiency to thoughtful effectiveness.

GTM trends for 2023

In 2023, customer centricity will be a strategic priority, not just lip service.

Customer centricity is often flaunted, but rarely delivered. Most organizations claim to be customer-centric, suggesting they put the customer first when it comes to customer service, pricing, product development, etc. However, it only takes one problem with your cell phone, travel plans or systems implementation to starkly clarify that indeed you are not at the center of the organization’s interests – their profits are firmly holding center like the sandworm from Dune.

It is true that firms can highlight legitimate examples of customer centricity, where the customer really is treated as a partner. But these are examples, not the norm. Take your choice of pressures that keep organizations from being laser-focused on the customer:

- Wall Street pressure to increase margin, thereby reducing investments in upgrades;

- IPO pressure to realize valuations faster thereby reducing expenses and not hiring more customer support staff;

- Commission that kicks in when the deal is sealed, reducing sellers’ willingness to wait and develop the right solution.

The fact is, most organizations consistently choose short term gains over long term, larger opportunities which demand customer-centric behaviors. This is not news, but it is a systemic practice that ironically limits what we most want; stronger customer relationships, and more revenue.

What we know from our own experience as humans, (and organizations are just a collection of humans), is that when we are treated as an equal, are listened to and supported, have a say in what happens to us, and feel truly valued, we become more loyal, tolerant of mistakes, and likely to spend money. Full Stop. When this happens in a sales process, the results are not only larger deals, but longer lasting relationships and more VP contacts who want to engage. Today, more and more organizations are paying attention to this reality.

This is what we’ve observed across our global B2B tech client base:

Customer centricity, integrated into GTM teams, at scale. Microsoft, Kyndryl, and Salesforce all have “elite” design thinking/co-creative consulting teams that work with their most strategic accounts to grow partnerships. They also are all trying to scale these design-led skills to the entire GTM organization. This is not an easy task given the size of the sales organizations and the reality that all GTM employees do not need the same skills. For GTM organizations, it will be less about designing and facilitating a full “Envisioning” workshop (for example) and more about a practical shift in mindset to one of co-creation. For example, can you meet customers where they are and help them problem-solve in their language and toward their outcomes?

Customer adoption/consumption becomes an account executive’s responsibility. Customers have become much savvier technology buyers. As their journeys to the cloud mature into multi-cloud strategies, they want to tie their investments to tangible business outcomes and realized business value. For GTM organizations, this means sellers need to know their customer’s goals more deeply (often across multiple business decision-makers and departments). It is no longer going to be good enough to get a signature for a volume of licenses, and then outsourcing business outcomes to customer success and a strategic implementation partner. You will see commission structures and price discounting shift to incenting consumption. Sellers will be far more involved in ensuring adoption post-sales. We see this as a migration from SaaS (Software as a Service) to CaaS (Consumption as a Service).

Co-creation as the way to sell complex, multi-pronged deals. Lastly, the reason many B2B firms have an elite design thinking/co-creation team to work with their most strategic accounts is because they know if they invest the time and money to co-create with their customers, the odds increase 10-fold in their favor that a much larger partnership will evolve. Co-creation looks like:

- Envisioning the future of the partnership and all the possibilities for transformation,

- Determining business value,

- Thinking through implementation pathways, and

- Deciding on a solution TOGETHER.

No one washes a rental car. Why? Because it is not theirs. If you want your customers invested in you and your solution, you need to co-create it with them. Involve them early in the sales process, get their fingerprints on the solution.

As one account executive told us, “I involve my customer in my account planning process and I make sure my team never talks tech – we only talk business outcomes and how we will work together to achieve them.”

In September, 2022, the President of VMWare, asked the CIO of CVS (one of their largest customers) what he wanted in the future from VMware. The CIO did not hesitate. He said, “that you co-create with us.”

The Rise of Inbound-led Outbound

Pre-2023

Peanut butter and jelly, two great flavors that belong together.

Peanut Butter: As CMO, most of my KPI’s hinge on Inbound. Traffic to our website, conversions, inbound leads. Not all nuts make the mix, though. Industry CR%’s are typically 3% (we’re similar); Which means 97% of traffic goes away silently, quietly, anonymously. On the other side, typical Inbound lead-to-SQL (Sales Qualified Lead) rates average <40% (we’re slightly higher); Which means disqualification rates are higher than half for hand raisers…! Put simply, inbound is hard (but necessary and useful for building pipeline).

Jelly: As CMO of a lead generation company, primarily associated with services, the vast majority of outbound campaigns run are straightforward List-led Outbound campaigns. They produce SQL leads anywhere from .05 – 4% of Contacts passed and usually depend more on the value proposition, persona/ICP (ideal customer profile) chosen, and brand than other factors. An aspect that makes this effort more difficult — and leaves much to chance or luck — is a prospect’s in-market status, not to mention relative familiarity with a vendor’s brand. Put simply, cold outbound is hard (but necessary and useful for building pipeline).

Buying Reality

Countless analyst firms who study buyer’s journeys all say the same thing — the vast majority of time spent in the buy cycle is spent researching independently online, while B2B buyers do an average of 12 searches before engaging with any specific brand’s site. Which actually squares with the average conversion rates above.

Basically, whenever or wherever a buyer’s fancy is struck, turning to Google or Social Media for more information is the name of the game. And as CMO, trust me when I say there are real costs to bringing anyone/everyone to one’s website. Investments in ads, social, content, or referral traffic are borne in virtually every marketing department, hourly.

It’s also not uncommon to have most Inbound SDR’s focused only on prospects who’ve taken a commit action (filled a form; identified themselves). This while List-led Outbound SDR motions typically roll up to sales (stuck in the jelly jar!) and are subject to the often random choices of which part of the ICP to target.

Alas, the myriad marketing vs. sales debates find a home here, too, as no one truly owns buyers who don’t yet reveal themselves.

Winning Strategies for 2023 (and beyond)

As technology has evolved — primarily website visitor identification software — we’re finally(!) (at least here at CIENCE), able to identify formerly anonymous website visitors and follow-up with those that fit our ICP. The ability to have a decent match rate and then follow-up with unconverted, yet more familiar prospects, is a winning combo. Like peanut butter and jelly, two great flavors that belong together.

We call this Inbound-led Outbound and this is the primary outbound motion for our SDRs. It makes sense for us to prioritize these leads above all others as it’s actually more effective to set meetings and start sales conversations because of their actions (visits to our website).

2023 is a year of vast change for SaaS. Everyone connected to the industry will be affected in some way. The global economic conditions will impact every industry, company, and person, although SaaS is particularly interesting as it’s an industry which has allowed itself to become hyper-dependent on large sums of operating capital.

In fact, capital was flowing so enormously into SaaS over the last decade that the entire industry became a game predominantly incentivized by inflated valuations rather than customer value and healthy profits. That means founders and investors had more financial incentive to grow the valuation of the business than they did to deliver value to customers and generate sustainable profits.

This became possible as a result of unusually large sums of money pouring into the market, much of which made its way into SaaS. When money is easy to get, businesses start operating differently because they can make more money by increasing the value of their stock/equity and then selling it at a higher valuation, than they could taking the long road to building a sustainable business that actually has happy customers and healthy profits.

If any of this sounds familiar, you’ve probably been working in SaaS and have experienced that emotion of wondering why it seems like the business is growing but everything is a mess at the same time. That’s often because the business was mostly garbage but the metrics and story were good enough to increase valuation and raise the next round– further enriching the founders and investors while the employees and customers are left wondering what all the hype is actually about.

Now that we’ve covered the obvious, let’s talk about how this is already changing the entire industry and what it means for GTM in 2023 and beyond. First topic is going to be cost cutting and workforce reduction. This one is already in motion but it’s going to leave an everlasting change on the industry. Similar to how COVID forced the Enterprise Sales world to finally learn how to close $100k+ deals over Zoom calls– now we’re going to see similar changes take place that will change the way GTM and sales function forever.

Sales, Customer Success, and Support are already and will continue to be gradually replaced by automations, AI, robots, etc.

This is happening for 3 main reasons:

- The technology is getting better at increasingly faster rates. Tools like ChatGPT are only the beginning of what’s coming

- Millennials are taking over B2B Decision Maker roles (estimated to have 100% by 2025 by Gartner) and millennial buyers actually prefer automation VS live sales interactions, so the timing is convenient

- Companies are being forced to cut costs, and Sales has always been the most expensive department in the company, so it’s the obvious place to invest in more automation

With these three forces coming together at one time, it’s inevitable that we will see more companies choosing to go to market without a traditional sales team and instead investing more time up-front developing more detailed user experiences that take prospects entirely through the process of becoming a customer without having to interact with a live human aside from some supplementary email or chat support.

It’s easy to think of reasons to believe your product or service can’t be sold without a salesperson, but that’s only because many of those products will never survive, and instead, they’ll be replaced by new competitors who win strictly because they were designed with the intention of having a flawless purchasing experience.

And we’ve seen this play out in the past with companies like Slack who became a $1.2B company in two years with no sales team. They only achieved this because they obsessed over the user experience and they considered users to be free trailers– which most companies don’t pay much attention to, but instead they focused their engineering and design efforts on perfecting that experience so they could grow without an enormous sales team.

But historically developers and tech teams jump right into building the solution to a problem without paying much attention to building into that solution, the actual process in which a potential customer will convert into a long-lasting customer. But this is the ultimate utopian objective of what many refer to as Product Led Growth (or PLG)– but historically PLG has been more around growing existing customer bases. Now it’s about the full sales cycle for all of the reasons described above.

Like I forecasted in my online course, The Modern Outbound System™, it will start with new “Buyer Enablement” tools that aim to enable easier remote selling experiences. They’ll bring all stakeholders together into one digital environment where content can be shared, communication takes place, and live meetings are logged for record. These tools will help to manage the sales process and replace former tools that focused on mutual action plans and things of that nature.

I see these tools as the first CRM that customers will actually have access to, since that’s essentially what it becomes. For example, a customer should be able to log in to these tools and modify or change dates for meetings or projected close dates, etc. They should be able to see notes from the salespeople and add their own. These tools should be designed in such a way that it’s extremely simple and intuitive so that it puts the buyer in the driver seat as much as the salesperson always has been– this is Buyer Enablement.

If you think about what’s happening in the platform described above and combine that with the advancements we’re seeing in conversational and human-like AI, voice analysis, sentiment analysis, etc., then I think it’s safe to say I’m a firm believer that Salespeople are on our way to being replaced by lines of code, robots, etc.

However, I do believe that people like learning from people, so I foresee each company indefinitely employing at least 1 or 2 salespeople who will become the “Billy Mays” of SaaS and will focus their time on producing video content which will get fed into these tools. Then where sales managers today would iterate on scripts and train the sales team, these new types of salespeople will iterate on their scripted videos and continue to advance the programming logic of the AI so that it keeps getting better and better.

While this is scary for many people to think about their company going from 300 salespeople down to 3, it’s also an exciting time for the industry and for the customer because the process is truly going to be narrowed down to a pure science and the endless uphill battle of trying to train large amounts of people with enormous amounts of boring technical info, that’ll simply be recorded once or twice, and those segments will be dished out as needed first by humans recycling them, but over time by AI who learns how to recycle them better than the human did.

It’s already been true that Salespeople have been spied on for years. All of the data recorded from your demos, your calls, your email cadences, etc. That data will soon be used to program AI that will take your job away, do it better than you, never take breaks, and never ask for a paycheck or vacation time. We saw it happen to cashiers, and it’s happening to car salespeople as Tesla modernizes the industry and proves people will order cars online.

It’s scary when the world changes and jobs are replaced by technology, but I think it’s actually more scary to think that humans would forever need to work 8+ hours a day 5 days a week just to barely be able to provide a fulfilling life. If we continue to replace manual and time consuming labor with intelligent automation, machines, and robots, then we are inevitably headed into a future where someday 8+ hours a day for 5 days a week will not be necessary.

If we continue automating, eventually humans can work a couple years of their life and then live like children until their eldest years while their homes are built by robots, garbage is collected by robots, food is farmed, cooked, and delivered by robots, etc.

It’s difficult to imagine that future now because of our limited perception of time, but if we continue on this trajectory that’s where we’re headed which is why I find it more inspiring to focus on those bright possibilities rather than the downsides that come with innovation along the way.

Focus on finding your place in the new world and being ahead of that curve and there will always be something meaningful to do. It just may not be working on a team of 300 salespeople at a SaaS company memorizing sales scripts all day. Those will simply be programmed into the AI, and they’ll never get something wrong twice.

Lastly, another enormous GTM innovation is that MVP’s will increasingly be built on no-code platforms like Bubble.io, which I believe will over time actually replace traditional coding foundations. The reason for this is that roughly 80% of the features built for an MVP are all the same. It’s shocking but it’s only about 20% of the build that actually makes a product unique.

So as an industry, we actually have a massive workforce around the globe engineering the same features and functionalities over and over for every startup because they all need login pages, user management pages, administrative privileges, dashboards, reporting capabilities, etc.

Meanwhile, what no-code platforms like Bubble.io are doing is building out standardized templates for all of these functionalities which will over time become as good, if not better, than the stuff an engineering team takes the first 12 months to build from scratch. They’re designing these in such a way that you can start with the no-code templates, but then continue to add custom code to them to evolve your product. But this allows for streamlining a huge majority of the work, and we will see folks who were historically only designers, now able to be full product engineers on these new platforms.

This is again, a topic that could be perceived as a bad thing because it could take away the need for early-stage engineers– this is true, startups won’t need them like they do today. Instead people like myself who know a lot about software, have tons of ideas, but don’t know how to code will actually be able to drag and drop their own MVP together on a platform that can later be professionally developed into later product stages without the need for a rebuild.

The reason this is good is it lowers the barrier to entry, reduces the time and cost of getting an MVP off the ground, and most importantly, it allows engineers to focus their time on developing new, more advanced technologies since we don’t have the need for so many to sit around and continuously rebuild the same features.

Did I mention how magical these universal platforms will make integrations? It will bring integration capabilities to the point of no longer needing separate login credentials for multiple tools because eventually the tools themselves will be blended straight into the same platform you’re working out of since they’ll all mostly be built on 1 or two of the big market shareholders that eventually dominate the space.

2023 will be the year of where partner ecosystems emerge as an efficient, predictable, scalable and sustainable source of new ARR and NRR growth. Partner ecosystems will move from being an island trapped in channel stovepipes to become a core driver of business transformation built around improved business models (network effects and sustainable growth), improvement in customer experience and business outcomes, and more ethical and honest business practices.

In 2023, B2B needs to take a lesson or two from B2C. Customer-centricity and customer experience will no longer be enough to move the needle for business growth because it doesn’t account for the buying experience that happens before they become a customer. As a result, response rates will plummet and sales cycles will lengthen because buyers will feel unable to make a decision and manage change within their organizations.

1000 business buyers surveyed by Gartner found 80 percent “voiced uncertainty in their own ability to manage such change.”

In their book Stop Selling and Start Leading, co-authors Deb Calvert, Jim Kouzes, and Barry Posner, PhDs from Santa Clara University, used research and data from retail to find out how to help sellers create more delighted and evangelist buyers in the B2B world. What they found was that what buyers value most in a salesperson was the ability to collaborate with them to come up with new ideas and insights and challenge the way they thought about their problem.

The role of sales in 2023 is as a change agent- helping buyers to collaborate on solutions and make decisions.

Early-stage startups and small businesses will gain a competitive advantage over larger brands because of their ability to be agile and collaborate with buyers. This means combining digital buying resources with a seller who can meet buyers where they are in their process and ask collaborative questions that are not all about their sales process and product.

Those who make buyer experience first and foremost in their GTM strategies will differentiate themselves from the competition because of how they sell, not what they sell, have higher customer lifetime values because buyer’s place higher value on solutions they feel they had a say in, and more predictable pipelines because they have created a buying experience that exceeds expectations.