Making Balanced Decisions in an Unpredictable Economy

Time to read: 9.4 minutes

Our decisions impact our success, development, and ability to grow. We need to find a better way to make them.

Whether we’re experiencing an economic upturn or downturn, the choices we make are critical to our success. For business leaders, there’s a never-ending string of decisions to be made. Usually we optimize processes that we repeat frequently. Can we make decisions in a better way? The short answer is yes.

Business leaders face challenges and opportunities every day. Decisions about who gets hired, how to target the right audience, what should be prioritized and when, are just a few examples. These decisions have a ripple effect throughout a company with the ability to impact everyone down to the newest intern.

As the world continues to change, so does the way we make choices. Leaders no longer have to rely on gut instinct alone to make the right calls for their business, and we have increasingly more data and tools to do better. Making balanced business decisions relies on having the right intelligence to guide your strategy and the know-how to use it.

What is a balanced decision?

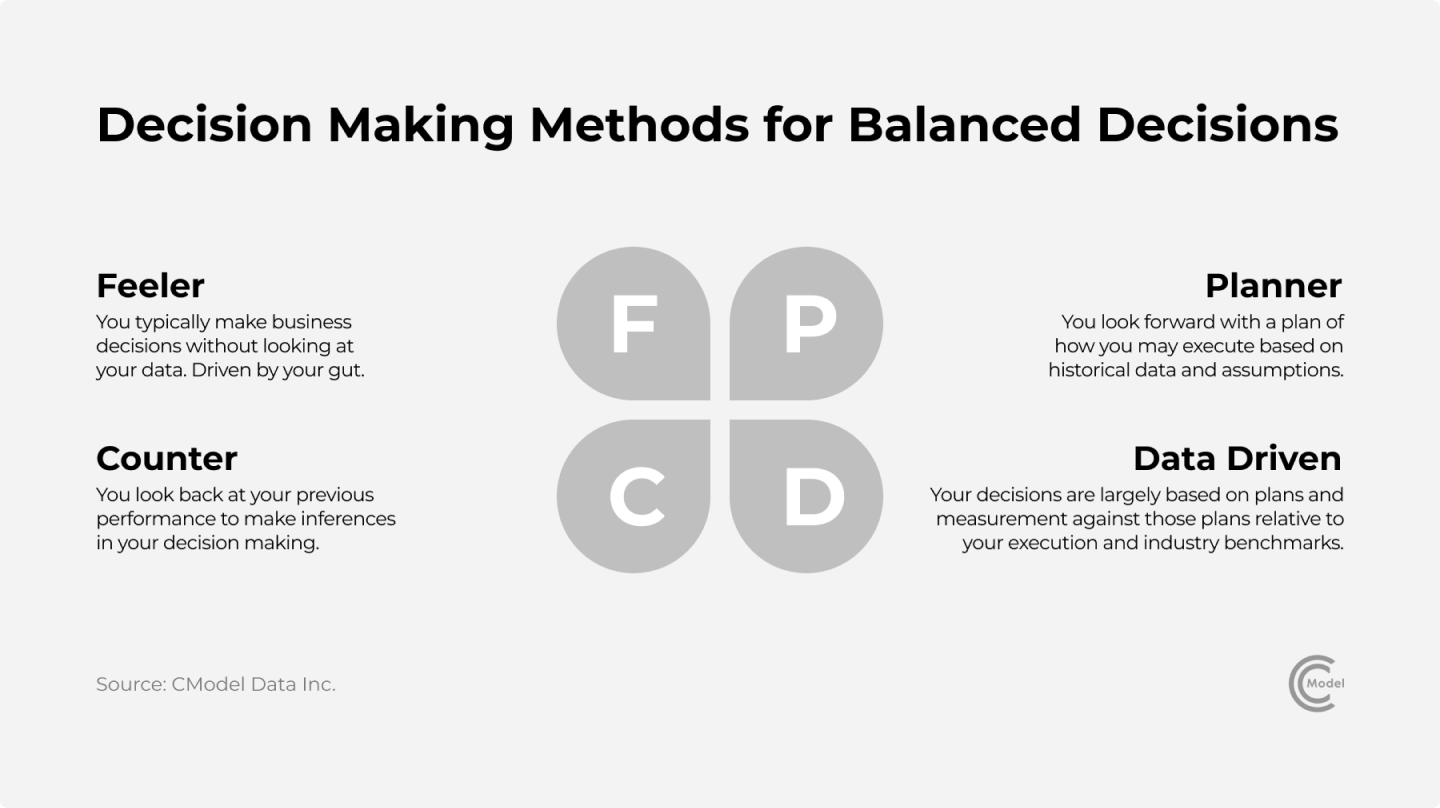

A balanced decision is one that uses a combination of instinct and experience, planning, and data-driven analysis. There are 4 methods of decision-making to consider.

1. Feeling.

These are the choices you make without looking at data. Whether you’re operating off a gut instinct or afraid of adverse consequences, feeling-led decisions often place importance on past experience or are generated based on how you feel about the decision.

2. Counting.

Making a decision by counting means that you take a look back at your previous performance and then you take guesses as to what might happen in similar situations.

3. Planning.

Plan-driven decisions involve counting but also use assumptions and modeling. While it’s important to understand the past to better predict our future, plan-driven decisions often ignore new and evolving information.

4. Data.

Data-driven decision-making includes using the actual performance against previous plans as inputs and also reviews your execution against various benchmarks. Having relevant statistics is critical to making balanced decisions, but over indexing on numbers can have unintended consequences.

Balanced decisions are ones that use these four methods, referencing the largest amount of relevant information possible, including how we feel.

The importance of relevant data in decision-making

It’s estimated business leaders spend nearly 40% of their time making decisions. Most decisions have immediate consequences. Relevant data links directly to desired outcomes and should support the decision’s context. This includes understanding why the decision needs to be made, when the decision needs to be made, and what is the timing of the decision’s impact.

To use the data we have to the fullest, we require a shared understanding of the data’s context. Typically business data is relevant when it corresponds to critical business metrics, assumptions, and benchmarks. Additional context such as how, when and why this data was created is relevant. Without context, this data is just numbers in a spreadsheet.

The economic climate and our strategies

Economic upturns and downturns create variations in the types of decisions we make and the timing that we make them. When we’re enjoying an upturn our goals are more growth-focused and immediate. A decrease in unemployment, a boost in wages, and an increase in consumer spending can be potential business drivers, new opportunities that we need to decide to take advantage of. Conversely, downturns call for a shift in goals, focusing on conserving resources to protect the business until there’s an upswing. As we’ve seen recently, this means deciding about layoffs, cutbacks, and how to manage debt.

Startups and small businesses are especially vulnerable during an economic recession. Their scale and funding scarcity can make it hard to stay afloat. Balanced decisions can mitigate risks for smaller and earlier staged companies who are seeking to avoid failing in the face of a downturn. In the face of uncertainty, a business’s survival depends on 3 things; identified risk, planning, and the ability to decide and act quickly.

Utilizing decision intelligence and decision support

For an already difficult process, decision-making gets that much harder in times of instability. With each action carrying more weight than the last, the unknown that a recession presents opens the door for hasty plays and emotion-driven decisions. This is where decision intelligence comes in.

Using Decision intelligence, or DI, companies can model outcomes and test assumptions. They can also access decision support to aggregate critical data to analyze, and deliver actionable insights to guide them through the decision-making process. These insights put relevant data behind decisions, setting businesses up for success down the road. Gartner, a research and advisory company, has placed DI at the Innovation Trigger of the Hype Cycle and is expected to peak in the next 2-5 years.

How do I make balanced decisions?

A balanced decision-making process thoroughly evaluates all available data. There are 6 parts to the balanced decision-making process.

1. Identify problems and challenges.

The best time to react to economic recession is before it happens. Staying proactive and identifying potential setbacks keeps you one step ahead of the crowd. Analyzing internal and external data to understand how the broader market impacts your critical key performance indicators is imperative.

Listen to your customers. What complaints or questions are you seeing repeat? Look at your industry. What trends are popping up? What are your competitors doing? Seeking out these trends and insights ensures that you’re ready to act when the time comes.

2.Gather information.

Data is required and relevancy and quality outweigh quantity. It’s important to consolidate sources and create a common language, so that analysis can be thorough and complete.

3. Identify and evaluate alternatives.

Identify and weigh your risks. You’ll also need to assess what you don’t know but need to know to support your decision and evaluate what processes need to be implemented to effectively gather new information.

While a decision may quickly present itself, identifying and evaluating alternatives can help deepen solutions and identify holes that would have otherwise been missed.

4. Analyze data.

Analyzing your data is the key step between choosing a solution and executing it.

Ensuring the data collected is correct, complete, and up to date is crucial. Data needs to be relevant for creating a solid go/no-go statement. Does your data confidently support the decision you’re making?

5. Decide and take action.

The scariest step is implementation. Any choice carries the risk of failure, but the process behind balanced decision-making is designed to mitigate risk and create the best potential for success.

6. Identify Success.

Once a decision is implemented, identifying how to track and measure progress creates an abundance of valuable insight to what’s going well and what can be improved.

Modern decision-making for a constantly evolving world

We have more information than ever right at our fingertips. The ability to make informed decisions has never been closer within reach. But, companies are struggling to make balanced decisions, creating a serious lapse in how we utilize the information we have.

Creating a system of balanced decisions can help companies to navigate the impact of the inevitable fluctuations in the economy, whether it’s an upturn or a downturn.